california competes tax credit carryforward

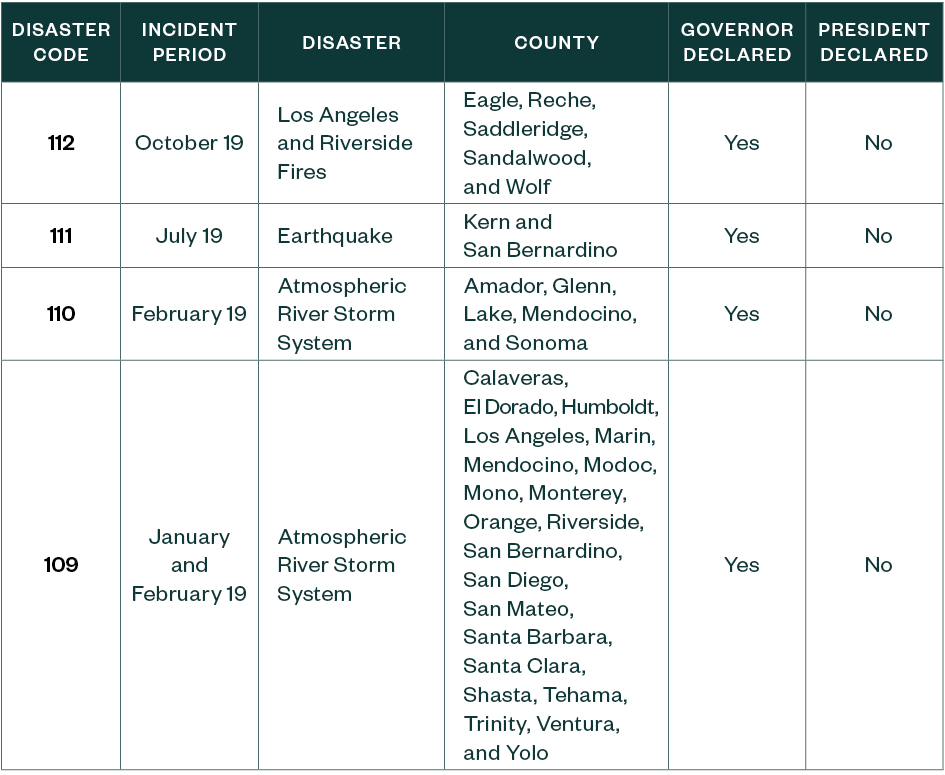

Businesses of any industry size or location compete for over 231 million available in tax credits by applying in one of the three application periods each. A taxpayer may carryforward the credit for six taxable years after the taxable year in which they earned the credit.

Final Course Exam California 2 5 Docx Question 21 Question Text Which Of The Following Statements Regarding The California Competes Tax Credit Is Course Hero

You can download or print current or past-year.

. The California Competes Tax Credit. The California Competes Tax Credit California Competes Tax Credit. 140m available in tax credits.

In 2018 the program was extended for an additional five years with at least 180 million in tax. Credit against the income tax due the Franchise Tax Board Non-refundable 6 tax year carryover Legislation signed by. California Competes Tax Credit Carryforward.

The California Competes Tax Credit is administered by the Governors Office of Business and Economic Development GO-Biz. We last updated the California Competes Tax Credit in February 2022 so this is the latest version of Form 3531 fully updated for tax year 2021. It is a non-refundable income tax credit with a.

A comprehensive list of every business that has received a California Competes Tax Credit. The California Competes Tax Credit Program with the Office. Name Download Link Primary Locations Industry Net Increase of Full-Time Employees Investments.

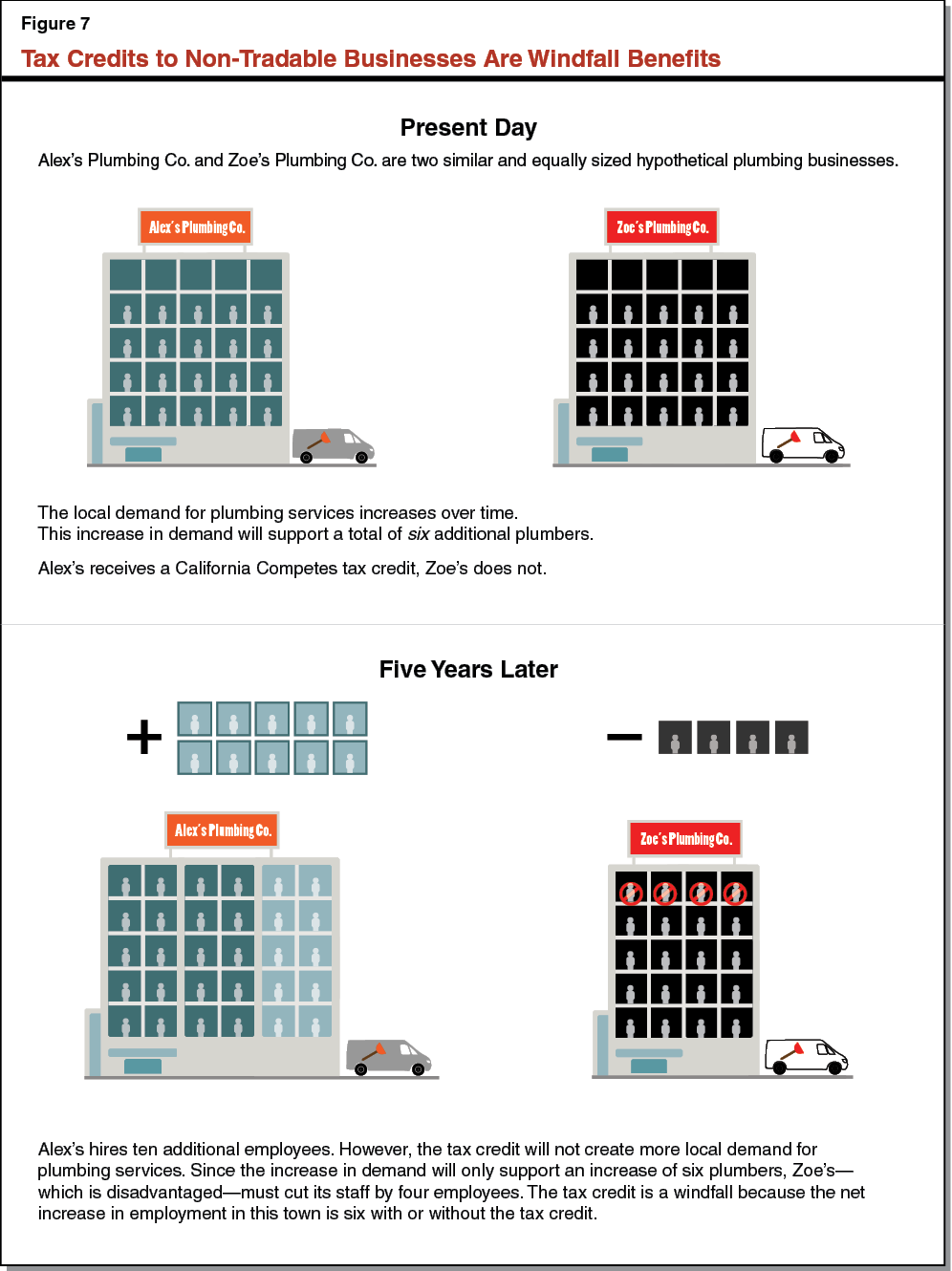

The California Competes Tax Credit CCTC is an income or franchise tax credit available to businesses that want to grow in California and create new quality full-time jobs. If a taxpayer does not have sufficient tax liability in a year with a credit installment there is a six-year carryforward period to utilize the credit. The California Competes Tax Credit is to attract and retain high-value employers in California in industries with high economic multipliers and that provide their employees good wages and.

California Competes credits have been as low as 20000 and as high as 6 million. All applicants compete against one another for a limited pool of funds with a special 25 allotment for small.

California Competes Tax Credit Relocation Credit Los Angeles Cpa

Work Opportunity Tax Credit Extended Through 2020 Weaver

Tax Credits And Incentives To Benefit Growing Businesses Part 1 Marcum Llp Accountants And Advisors

California Competes Tax Credit Application Period Opens July 20 Deloitte Us

California Competes Tax Credit Relocation Credit Los Angeles Cpa

Tax Season 2020 California Businesses And Individuals

How To Secure California Competes Tax Credits

California Competes Tax Credit Application Period Opens July 20 Deloitte Us

California Competes Tax Credit Application Period Opens July 20 Deloitte Us

California Tax Incentive S Success Is In Its Failures 1

85 Million In Tax Credits Available For California Businesses Advocacy California Chamber Of Commerce

Last Chance To Apply For Tax Credits And Grants For Your Business Eastern Sierra Now

Application Window For California Competes Program Opens July 25 Pwc

California Competes Tax Credit Relocation Credit Los Angeles Cpa

California Competes Tax Credit Relocation Credit Los Angeles Cpa

Work Opportunity Tax Credit Extended Through 2020 Weaver

Review Of The California Competes Tax Credit

What Is The R D Tax Credit Who Qualifies Estimate The Credit